Even though Bloomberg recently downgraded its forecast for US economic growth in 2020 to around 2%, this would still mark an 11 year unbroken period of growth. Many people reading this article will be surprised by that fact, especially when you bear in mind the political, economic and international trade concerns currently hounding the US. Indeed, despite Donald Trump’s many political woes there is a general consensus that he will walk back into office at the next election.

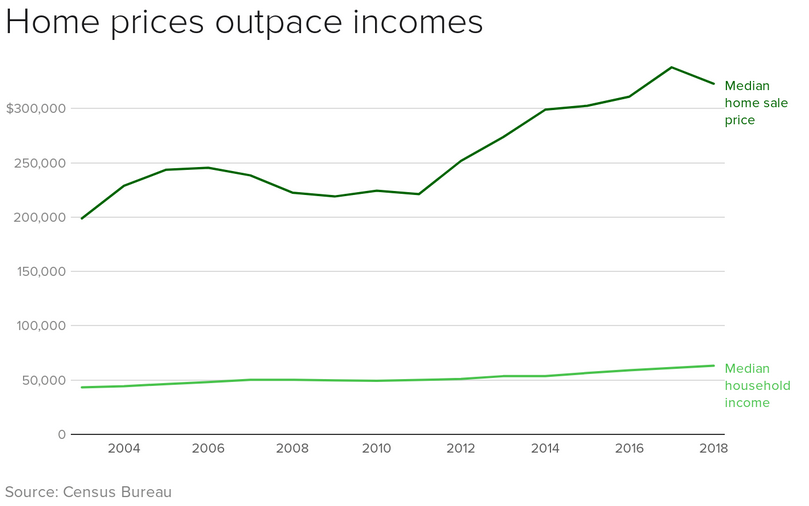

House price growth leaving incomes behind

Continued growth in the US economy has led to a significant hike in US property prices over the last decade or so. A recent report by CBS News confirmed the fears of many; average wage earners in 71% of US counties were not able to afford their own property in the final three months of 2019. Even though this is an improvement on the previous quarter figure of 73% and 75% from the corresponding period last year, it is still very disappointing. The following graph perfectly illustrates these growing concerns.

In many ways it is the switch from property purchase to property rental which is causing the boom in prices. While the performance in the final quarter of 2019, which saw a staggering 9% year on year growth in property prices, cannot be repeated, analyst still expect annual growth in 2020 of 2.2%.

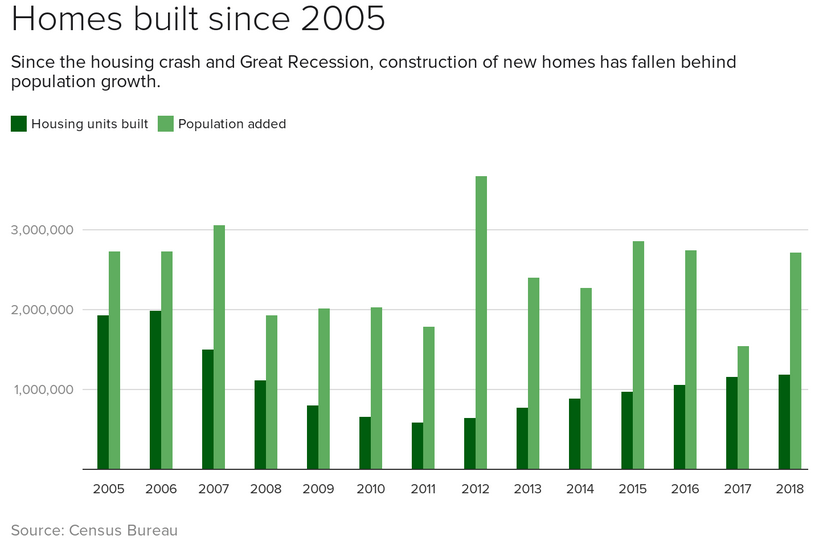

New build properties

If you look at the graph below, you will see that the number of newbuilds has lagged population growth (since 2005 on this graph). Indeed, 2012 was a phenomenal year for population growth although housing newbuilds were just off their historic low. Interestingly, since 2011 there has been a constant year on year increase in the number of newbuilds. Donald Trump will need to ramp up this increase significantly to get anywhere near a balance between newbuilds and population growth.

As with many other countries around the world, Donald Trump is faced with a difficult situation. An immediate increase in newbuilds would potentially dilute property price growth in the short to medium term. This would obviously be good for those looking to climb aboard the property ladder but reduce returns for both investors and current homeowners. A difficult quandary!

The economy is the key

While the US has encountered a number of difficulties with international trading partners, the EU and China to prime examples, many experts expect these to be short lived. Even though Bloomberg recently downgraded economic growth forecast for the US it is still on target to record an 11 successive year of economic growth. Many have criticised Donald Trump in his role as president of the USA but one thing is clear, he has delivered on his promise of America first.

Unfortunately, this ongoing economic boom in the USA has the potential to further alienate potential first-time buyers who even with low interest rates are struggling to raise finance. Unless this is addressed, we will see further movement towards the rental market, putting pressure on house prices and pushing them further and further out of the reach of first-time buyers. In reality 2020 looks like being a good year for investors in US property but a challenging year to say the least for first-time buyers.