To say that the London commercial real estate market is under pressure is perhaps a statement of fact bearing in mind Brexit and the ongoing confusion. If you read the newspapers, follow online news portals, it seems as clear as night follows day that London property is being shunned by overseas investors. So, if that is the case, why has London been the top city when it comes to worldwide commercial real estate investment over the last two years?

London commercial real estate investment

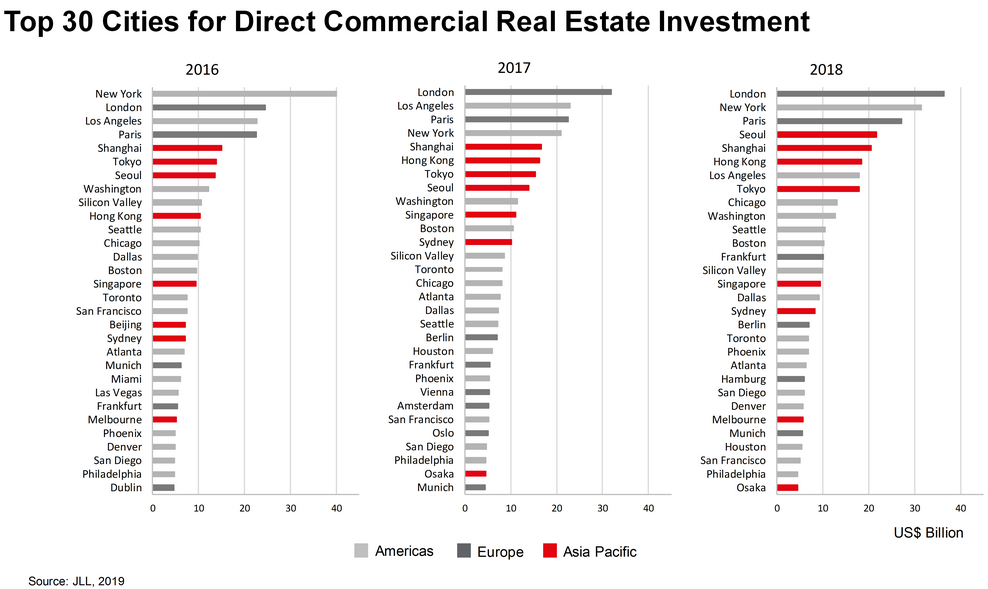

In 2016, investment in London commercial real estate topped around $24 billion, rising to $31 billion in 2017 and a staggering $36 billion in 2018. Over the last three years the cumulative investment in commercial real estate in London has topped $90 billion. This is similar to the cumulative investment in New York with up and coming stars such as Paris, Los Angeles and Shanghai falling well short.

If you read the real estate press you will hear about the “growth stories” in Los Angeles, Paris, Silicon Valley and Washington. So why is it that despite the fact London, during perhaps its weakest period in living history, receives nothing but critical comment despite being on a par with New York – and still head and shoulders above the rest?

Overseas investors in London property

It is very easy to be overcome by press headlines, regarding the EU and the U.K.’s future relationship. Will it work, won’t it work, will article 50 be revoked and will Brexit eventually be cancelled. These are just some of the questions which UK voters are demanding answers for in the short term. At the same time, the general trend for sterling has been downward since the 2016 referendum. Indeed over the period sterling has lost around 20% against the likes of the euro and the dollar. In fact some experts seen further downside in the short term unless the Brexit situation is somehow rescued by Theresa May and/or Parliament.

This comes at a time when the UK economy stronger than its European counterparts, employment is at record lows and despite a prolonged period of austerity, we are starting to see some budgets increased. Whatever happens with the Brexit situation it does seem as or we are approaching the end of austerity in the UK with voters simply having “had enough”. So, the next government will need to be more appreciative of government spending and public services as well as targeting funding where it is actually required. That said the UK plc balance sheet does not make for good reading with net debt well over £1 trillion.

Buying on weakness

It will be interesting to see as and when foreign investors turn on the investment taps a little further. We know that some investors are just waiting for the opportune moment when the UK hits rock bottom prior to the Brexit situation being resolved. Make no mistake, the Brexit situation will not be prolonged for much longer as the options available to Parliament/government and the timescale are quickly diminishing.

Further short-term weakness in the pound against the euro and the dollar is likely to prompt significant investment from overseas. The City of London has taken a pounding in the press but still lives to fight another day. Many people forget that London has been through many different challenges over the years, wobbled, took a standing eight count and continued the fight. Those who write off London as a consequence of Brexit do so at their own risk because the City is far from dead.