Miller Howe, known as one of the best hotels in the Lake District, is up for sale with an asking price in excess of £3 million. The property originally came to the attention of diners after John Tovey acquired the property in 1971 with an investment of £53,000. This is an area of the world which continues to attract a growing number of tourists and the fall in the value of the pound against the dollar has only accelerated this trend. So, why is Miller Howe so popular and is a £3 million asking price reasonable in the current market?

The history of Miller Howe

Originally acquired back in 1971, John Tovey went on to become one of the first celebrity chefs. Business success, cookbooks and a television series saw the reputation and the value of his hotel and restaurant business soar. AA rosettes and acclaim in the world of dining proved too tempting for John Tovey and the business was sold to Charles Garside the assistant editor of the Daily Mail and former editor of the European newspaper. It then changed hands again after it was acquired by the Ainscough family all the while growing in stature, reputation and visitor numbers.

High-class facilities

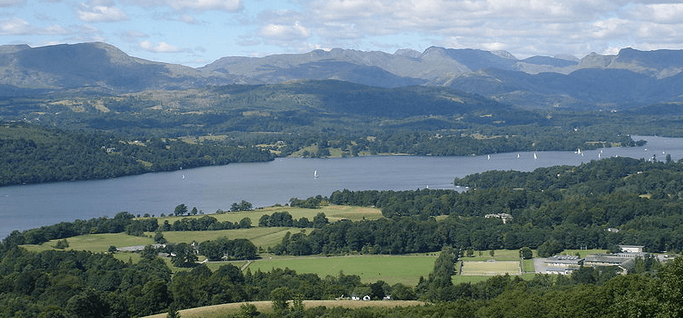

The AA three star hotel currently has 15 ensuite bedrooms, a restaurant with two AA rosettes and the obligatory residence bar and conservatory. Such is demand for accommodation and dining facilities that planning permission has been sought and granted for two additional ensuite bedrooms as well as an extension to the conservatory. The breathtaking views over Lake Windermere have certainly grabbed the attention of tourists and fine dining fanatics.

The fact that planning permission for new hotels and similar business properties in the region is extreme difficult to obtain means that the value of long-term existing properties/businesses will continue to grow.

International demand

Over the last 12 months or so we have seen a significant increase in overseas investment in the UK. Just a few months ago Langdale Chase Hotel, which also overlooks Windermere, changed hands after an acquisition by Thwaites. While hotel assets can change hands on a regular basis, recent currency movements will certainly benefit those looking from overseas towards the UK tourist industry.

At this moment in time there is little prospect of a recovery in the UK exchange rate therefore a near 20% “exchange-rate bonus” for overseas investors looking towards the UK will likely be gratefully accepted. Miller Howe has come a long way since that initial £53,000 investment in 1971 but then again we have also seen a blossoming tourist industry across the Lake District.

UK assets

As we touched on above, exchange-rate movements have proved highly beneficial for foreign investors looking towards the UK. The UK real estate market is under a little pressure due to Brexit and political volatility which is proving something of a double whammy attraction for overseas investors. It is therefore highly likely we will see more headline UK assets changing hands in the short to medium term. This may be good for the real estate sector but foreign ownership of key overseas assets does not always lead to the land of milk and honey originally promised.