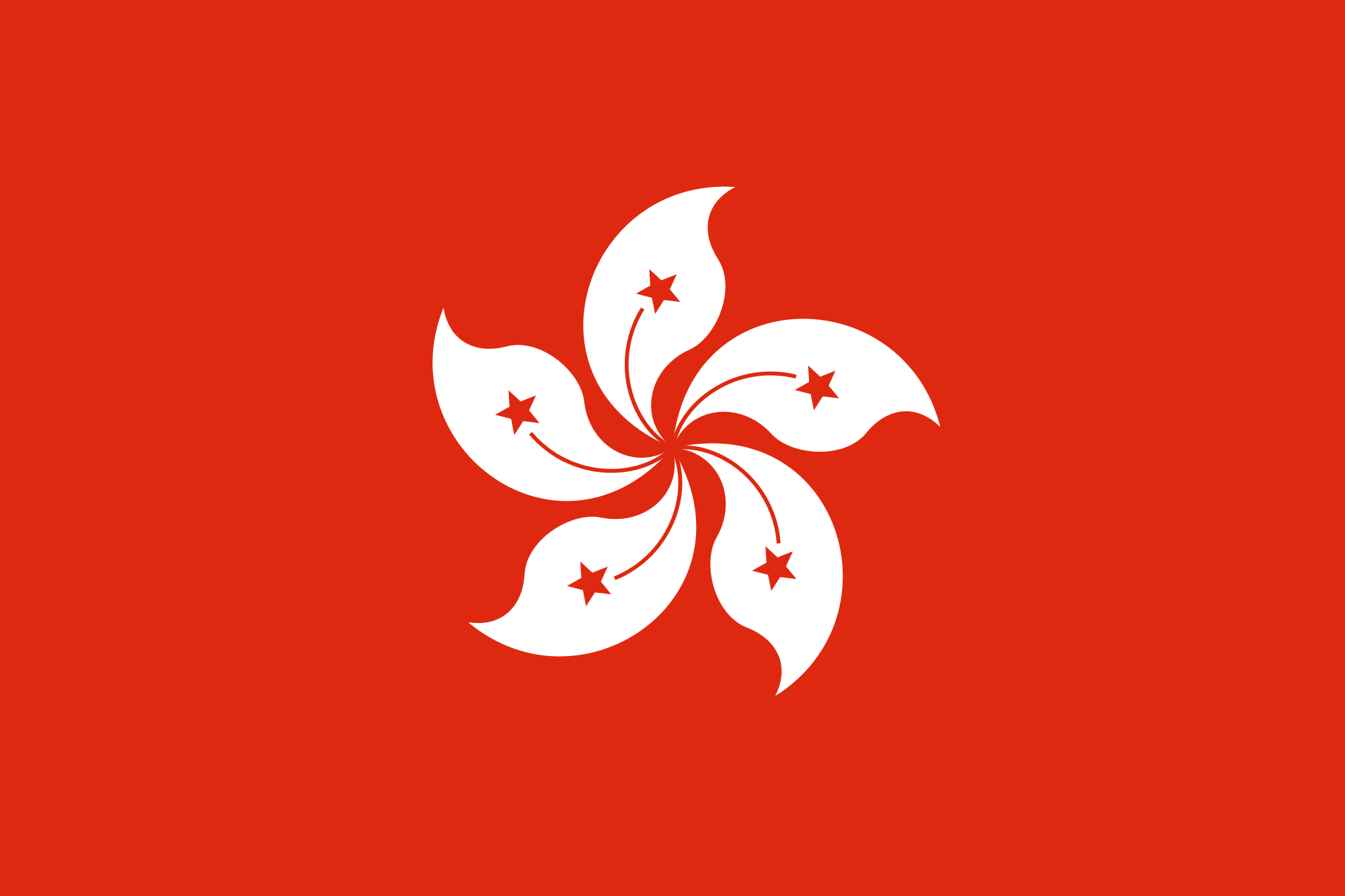

There has been and always will be a very strong connection between London and Hong Kong despite the fact that Hong Kong is now deemed under the control of China. Despite promises of a two state legal system, Hong Kong and China, the Chinese authorities have recently been looking to tighten their grip. While the Hong Kong leaders have backtracked on moves to allow the legal extradition of individuals from Hong Kong to China, so far the bill has not been removed from due political process.

Hong Kong investors looking towards London

The refusal of Hong Kong leaders to remove the extradition bill with China from the political process means that demonstrations will likely continue for some time to come. Despite the fact that the bill will die of natural causes in summer 2020, bizarrely the politicians have refused to withdraw it immediately. So, if the bill is effectively dead why not remove it from the political agenda?

London estate agents are already reporting a rise in enquiries from Hong Kong investors. We know that Hong Kong investors have been very supportive of the London property market for many decades. In recent times there has been concern regarding the UK political scene, Brexit cast against what many saw as a bright outlook for Hong Kong. The situation in Hong Kong has changed dramatically in recent weeks and as a consequence demand for UK property amongst Hong Kong investors is rising.

Currency movements strengthen argument

Earlier this year sterling was down around 20% against the dollar and the euro from the date of the EU referendum. As the Conservative party leadership campaign comes to a close, with the leader to be announced in the coming weeks, there has been further weakness in sterling. In what many see as pandering to the popular vote within the Conservative party, both Jeremy Hunt and Boris Johnson have both suggested they will pursue a no deal Brexit if EU leaders refused to enter further negotiations.

As the degree of political risk regarding property investment in Hong Kong increases, with sterling looking even more attractive, it seems inevitable that Hong Kong property investors will turn their sights back towards London. Despite the doom and gloom surrounding Brexit, London is a global city and while Brexit may turn out to be a major bump in the long term road to success, the city will not just disappear overnight.

Fading Hong Kong independence

The transfer of ownership of Hong Kong to China was deemed to be a quasi-form of independence with two legal systems running side-by-side. It was inevitable that the Chinese authorities would at some point look to tighten their grip on what is an extremely wealthy and influential area of the Far East. Politicians in Hong Kong and China must have known that the introducing of an extradition bill would cause significant unrest across the region. There is a growing opinion that this is just the start of a process which will see China take greater and greater control of Hong Kong.

It is difficult to say how this will impact the ultra-expensive end of the Hong Kong property market where demand has outstripped supply for many years. Whether underlying demand will carry forward in the short to medium term, supporting prices to an extent remains to be seen. However, the long term situation is attracting significant concern.

Even the mildest reduction in Hong Kong property price premiums could have a significant impact on property values. Watch this space…………