Aside from home improvements, debt consolidation is the most common reason for increasing the size of a personal mortgage. Consolidating debts into a mortgage is often the most effective way of reducing monthly outgoings although the monthly cost is not the only element that needs to be considered.

Factors to consider

While many people are often pre-occupied with the headline mortgage interest rate, the term of any finance is also an important factor. We have illustrated two very basic scenarios below to give you an example of how the term can impact the overall cost of finance:-

£20,000 loan at 5% with 5 years remaining

£377.42 per month – Total interest payable = £2,645

£20,000 of debt consolidated into a 25-year mortgage at 1.75%

£82.36 per month – Total interest payable = £4,707

So, aside from the headline interest rate it is vital that you consider the term of individual finance packages when comparing their pros and cons.

So, aside from the headline interest rate it is vital that you consider the term of individual finance packages when comparing their pros and cons.

How can you reduce this effect when looking to consolidate personal debts into a mortgage?

It is vital that you look at all of the options on offer before choosing a means by which to consolidate your personal debt into a mortgage.

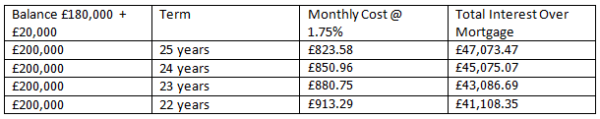

1. Reduce the term of the main mortgage at the same time as increasing the balance. While this will not give the same total reduction in monthly cost, even a small reduction in the overall mortgage term can save a huge amount of interest.

We have put together an example based around a mortgage of £180,000 and additional finance of £20,000:-

2. Look to arrange your mortgage in 2 parts. Many mortgage lenders let you arrange your mortgage over 2 different products on 2 different mortgage terms. This way you can consolidate your debts to a lower rate, while keeping both the mortgage and personal debt terms the same.

3. Use a secured loan rather than a full re-mortgage. You may be on an attractive mortgage rate which you don’t want to give up or perhaps tied in to your mortgage with a large early repayment charge. A secured loan is essentially a second mortgage, which sits above your existing loan. The term can be set independently of your main mortgage allowing you to still make a monthly saving while not extending the repayment of the debts to longer than necessary.

Companies such as NM Finance provide a whole of market offering with lenders who will consider debt consolidation up to 90% loan to value.