While billionaire Carl Icahn may have banked a profit on the sale of an unfinished Las Vegas casino he like many others has been forced to take a bath elsewhere. The unfinished Las Vegas property was acquired by Carl Icahn back in 2010 when the original developers went bankrupt. It was bought for a cut-price $148 million and is now in the process of being sold for a staggering $600 million.

Who has bought the property?

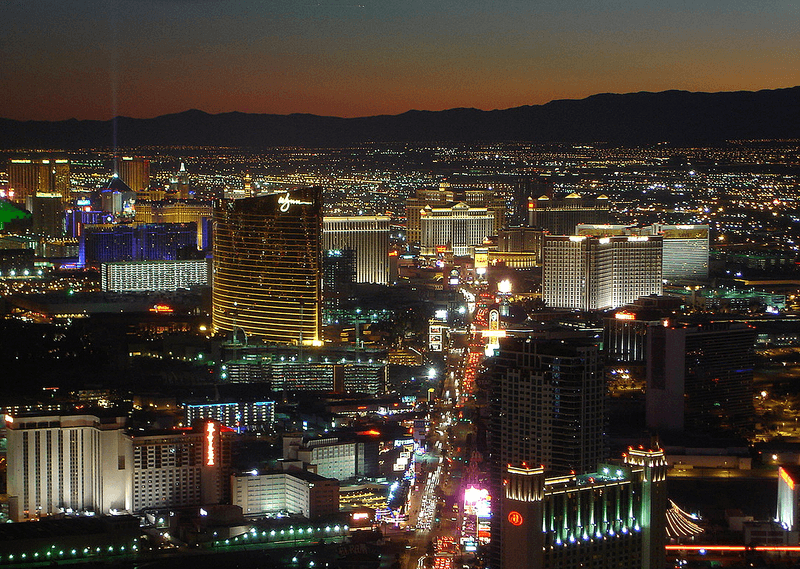

Steven Witkoff, a well-known New York developer, has acquired the tall blue building for $600 million and seems to have ambitious plans. The original blueprint for the casino development saw a 68 story hotel, casino and condominium project which was expected to cost a staggering $2.9 billion to build. As we saw with so many casinos in light of the 2007/8 economic downturn, demand suddenly dried up, developers began to struggle and many properties were foreclosed. However, the 27 acre site is on the infamous “Strip” and said to compete with an array of adjacent resorts.

The site is just across the street from the Las Vegas Convention Centre which is itself currently in the midst of a $1.4 billion renovation. So, while Steven Witkoff’s new project may have a chequered past it could turn a significant profit in the longer term and benefit from ongoing renovations in the area.

Casino developments litter the market

As we touched on above, while Carl Icahn will bank a significant profit on a failed Las Vegas casino project he has been forced to take a bath on a similar development in Atlantic City. In effect the property was handed over to the Hard Rock Cafe after being purchased from Donald Trump back in 2009. The reason for the “handover” was because of the required $375 million facelift which will be covered by owners of the Hard Rock Cafe.

There are many other failed projects including a $625 million plot acquired in 2007 by Diamond magnet Lev Leviev which was effectively written off in 2008 and foreclosed in 2015. Starwood Hotels and Resorts also had plans for an enormous $17 billion hotel project which was to be named the W Las Vegas. The timing for this particular project could not have been worse and despite acquiring an adjacent development for $202 million the project was cancelled in 2007. So, while we are starting to see signs of casino development sites being acquired for alternative use there could well be some bargains in the Las Vegas/Atlantic City areas for some time to come.

Conclusion

Las Vegas is renowned as a casino city and, as the US economy was in growth mode prior to the 2007/8 economic downturn, it was no surprise to see enormous investment in the area. However, many of the best-known property investors have been forced to write down developments in the region as demand simply evaporated and finance became hard to come by in light of the US mortgage led economic downturn.

It is interesting to see many of these previous casino developments changing hands and on the market with alternative uses in the pipeline. The markets in and around Las Vegas and Atlantic City will improve in due course but as we covered above, many prominent property investors have taken a serious bath on their casino development plans.